ATR, CWF Applaud DOL on Joint Employer Final Rule

On January 12, 2020, the Department of Labor issued its final rule interpreting joint employer status under the Fair Labor Standards Act. Americans for Tax Reform (ATR) and the Center for Worker Freedom (CWF) applaud the Labor Department on this rule because it will benefit workers and employers.

The Labor Department’s goals for the rule were “to promote certainty for employers and employees, reduce litigation, promote greater uniformity among court decisions, and encourage innovation in the economy.”

In order to meet these goals, the Department provided clear standards to meet the joint employer status in two scenarios. The first scenario occurs when an employee performs work for an employer that benefits another individual or group.

For this first scenario, the Department has adopted a four-factor balancing test to determine who is a joint employer. The four factors are: “1. Hires or fires the employee; 2. Supervises and controls the employee’s work schedule or conditions of employment to a substantial degree; 3. Determines the employee’s rate and method of payment; and 4. Maintains the employee’s employment records.”

In addition, the employer must directly or indirectly exercise one of the four factors. However, a reserved right to exercise this control does not automatically confirm a joint employer status.

The final rule also confirms that certain business models, business practices and other contractual arrangements do not make joint employer status more or less likely. Examples of this include brand and supply agreements and the franchise business model. The final rule also says that contractual agreements requiring an employer to comply with legal obligations or contractual agreements requiring quality control standards do not make joint employer status more or less likely. Finally, providing sample employee handbooks or jointly participating in an apprenticeship program also do not prove joint employer status.

In the second scenario, an employee works for two employers during the week for a separate set of hours. The Department did not make any changes to the standard for determining joint employer liability in this scenario.

ATR and CWF commend the Department on this final rule because it reverses an Obama administration 2016 legal interpretation that the Labor Department adopted and a 2015 National Labor Relations Board ruling. Under the Obama administration, the definition of joint employer was expanded, but this expansion has hurt workers and employers. In fact, the White House Council of Economic Advisers estimates that the prior expanded definition under the Obama administration costs $5 billion annually and reduces real income by about $11 billion.

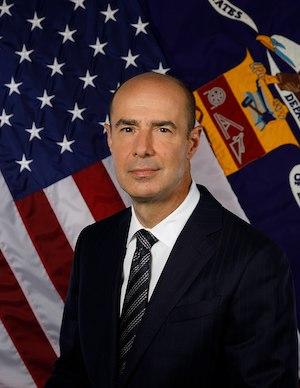

This deregulation, therefore, helps the U.S. economy, and as President Trump’s acting chief of staff, Mick Mulvaney, and U.S. Secretary of Labor Eugene Scalia correctly stated in their article, “Making Labor Rules Rational Again”:

“Actions like the new joint-employer rule demonstrate a core conviction of President Trump and his administration: Smart deregulation is good for the American worker, business, families and the economy. When we lift the heavy hand of government and allow businesses to create jobs, enter new markets, and compete at lower prices, every American wins.”

The combination of this final rule and the National Labor Relations Board’s own joint employer rule, which will be released soon, will allow American workers to flourish.